Investors

Scaling transformative businesses for global growth

We have extensive backgrounds as leaders and founders of advisory, creative, marketing and digital/Deep Tech/AI businesses.

Our experience in advising and creating, building and selling some of the most exciting businesses in the modern world means that we are passionate about innovators and business-builders – those who are driving growth by doing it their own way.

We have expertise in identifying and backing businesses with growth potential. When it’s time for them to scale vertically or geographically we understand what they need and sources of growth capital.

We take the time to understand your investment thesis, what you need to get investment committee approval and execute the transaction, and how to secure your target returns in the correct timeframe. Whether it is controlling or minority stakes, value creation planning or M & A we know how to help you achieve your vision.

We are experts at bringing the right people and the right capital together, saving everyone time, money and stress.

One of the things we’ve learnt from numerous conversations with PE sponsors and other investors is that otherwise attractive opportunities are often brought to them where:

- founders and leaders do not understand the role and value of external investment or what sponsors do and do not expect;

- the business has not been properly prepared and presented, the investment thesis and value creation plan are not sufficiently thought-through and executable, and the business is not investment-ready.

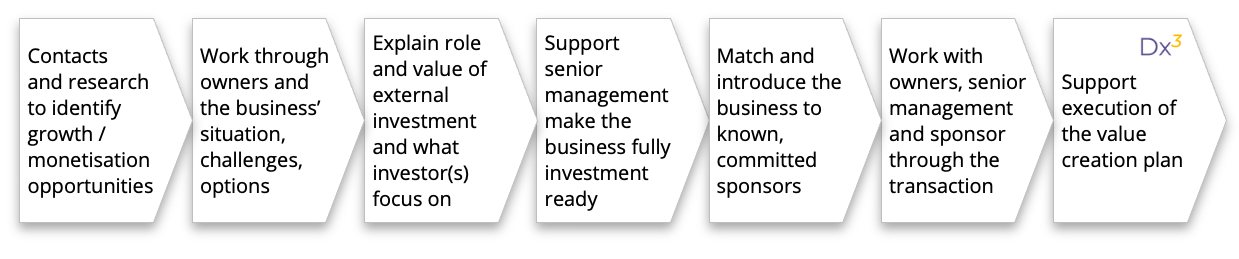

Our role is to work with owners and leaders to ensure that the businesses we bring to you are investment-ready, match your investment criteria and style/preferences, and are easy to present to your colleagues, investment committee and debt providers and other partners, which ultimately saves time and money.

How we work with Investors

An example of recent work (with the names retracted due to confidentiality) is shown below.

Case Study 2 – Working with a financial sponsor …

We supported a listed PE business in pursuing an exclusive off-market opportunity for a marketing services business. The multi £100m business had received limited capital investment in recent years and there was an opportunity for a new investor to grow and improve the business.

Our work over a 6-month period included providing a Value Vector-based investment plan along with multiple comparative EBITDA benchmarks for entry and exit points, and insight into the operations, synergies, key risks and opportunities in the business to enable an indicative offer to be tabled.

We then continued to work with the investor answering detailed supplementary questions to the VDD (Vendor Due Diligence) information provided and modelling target business performance as more detailed data became available. We advised on M&A strategy, acquisition integration, and professionalising the core business. We utilised our network to introduce specialists that weren’t readily identified by the PE firm.